I Get Down but I Get Up Again

Mypurgatoryyears/iStock via Getty Images

Introduction

Never in your wildest dreams (nightmares) did you expect to see a financial article title, with a variation of the title that some phone call, "The worst popular song always recorded." A British ring chosen Chumbawamba burst on the scene in 1997 with this stinker, that is both hypnotic and repulsive-you can't believe you lot oasis't muted it like a "Term Life" commercial. I was living in the Uk at the time, so may take heard it but once too oft on my morning time bulldoze into Aberdeen.

Getting to the betoken and the necktie-in between this vocal and Occidental Petroleum (NYSE:OXY), they were pretty much knocked down a couple of years agone. A number of "Become out while you tin can," articles laid out in copious item how the wall of debt would somewhen wash over them, wiping out luckless investors. That was about the fourth dimension I took a leap of organized religion and doubled downwards at $9.00-ish a share. The single best stock trade I've ever made, and one that continues to pay-I won't say dividends...even so, increase in value to this day. OXY is support again!

OXY will study its results on Feb 25th and expectations are high. Estimates are for them to double earnings per share to $one.08 from Q-3. With 934 mm common shares outstanding, this takes them to over $1.0 bn in earnings, or about a 12% crash-land from Q-3.

Analysts are becoming more than bullish on the company with estimates ranging from $24 (ok, that'southward not bullish, is it?) on the low side to $60-(now that's more like information technology), on the high side.

Oil prices-WTI and Brent have held firmly in the $70s and high $80s most of the prior quarter, and have nudged nonetheless high into the mid-$80s and $90s. (Take nosotros died and gone to heaven?) Price realizations for OXY should exist on the upwards, less whatever hedging they are locked into for Q-4, and going forwards, they are unhedged giving them the full benefit of today's higher prices.

We agree with the bulk of the analysts that OXY is undervalued. Debt reduction is on a abrupt downward glide path toward ~$twenty bn or so as we exit 2022. For a company with their capitalization of ~$35 bn, that'southward an entirely comfortable effigy. In one case there, then we begin to see sharply increased shareholder returns. We will discuss afterward in this article where we come across the stock going in the next year or then, assuming oil prices don't tank, of course.

A quick trip down retentiveness lane

Information technology was May of 2019 and OXY had merely upstaged Chevron (CVX) in its pursuit of Anadarko Petroleum. I put together a rather detailed rationale for this intensity on the part of Vicki Hollub, CEO of OXY, who was being absolutely pilloried by investors and weblog writers. I called it "Playing The Long Game In The Permian." Probably none of you have read it, so have a few minutes and give it a read. For those who don't have the time, I've put two graphics that capture the "Long Game" thesis for OXY below.

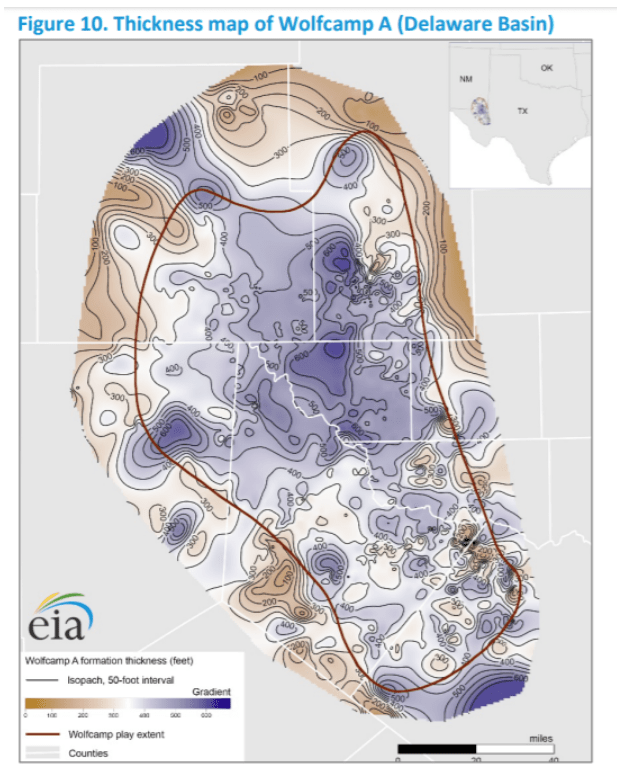

EIA

EIA

The graphic above is a depth profile map of the Delaware Basin. The more regal you run across, the greater the thickness of the Wolfcamp reservoir in that local. The Wolfcamp A has been 1 of the primary targets of shale frackers the last few years. Now, expect at the OXY map of the combined footprint of their visitor with the Anadarko acreage.

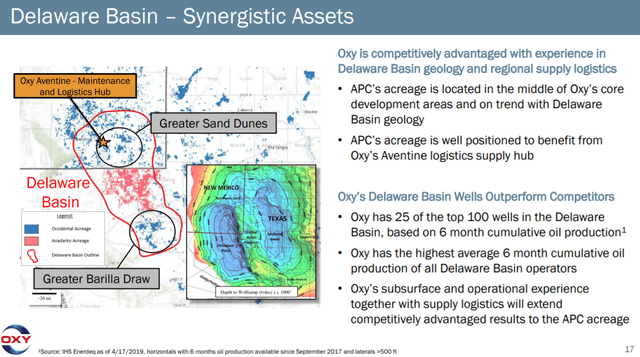

OXY vs APC acreage map (OXY)

OXY filings

A recent and widely commented upon WSJ article brings into sharp focus a trend that I take previously discussed in a recent commodity on Schlumberger (SLB). Collin Eaton, the author of the WSJ article must accept defenseless my thought.

The limited inventory suggests that the era in which U.S. shale companies could quickly inundation the world with oil is receding, and that market power is shifting back to other producers, many overseas. Some investors and energy executives said concerns about inventory likely motivated a recent spate of acquisitions and will lead to more than consolidation.

WSJ

It fits almost like a puzzle piece between two legacy sections of OXY acreage. If you have read many of my articles on shale producers, yous will retrieve my five-betoken mantra about shale survivors. For those who don't or just joined today, here they are.

1. Peachy rock. This can't exist overstated every bit information technology drives every other aspect. Natural permeability and porosity carve up nifty rock from other shale strata.

2. Scale. When you start "manufacturing wells," as opposed to a "bespoke" individual construction, you streamline costs. The bigger the "mill", the cheaper each unit becomes. There is no other road to depression cost production.

3. Logistics. Being able to road runway, pipelines to pad sites is tremendous advantage. One of the ways in which the ESG footprint of fracking operations will exist reduced is through superior logistics that minimize truck trips.

4. Connectedness. This enables the drilling of more three-mile and beyond laterals. This is the chief driver of increased product and capital efficiency.

v. Applied science. I am a techie and dearest the technological expertise that has helped to wring more oil out of the basis for less money-manner less coin.

In summary for this section, OXY built a company with the staying power to survive the incredible downturn we accept just come through. There were times when it looked like the marketplace would have them downwards. The debt they incurred was horrendous, and the market for nugget sales they accept promised to bring information technology downwards was moribund at times. Nosotros can look back and express joy at present, but it was nip and tuck until 2 things happened.

Outset, in 2020, they essentially rescheduled about $five.0 bn of curt-term debt coming due in 2021-2022, that they had no clear pathway to paying at that point. It was a triumph that they were able to do this, and shares began to ascension immediately thereafter. Near-term defalcation was off the table.

The 2nd thing was that at mid-twelvemonth, WTI began to rise, breaking out of the upper $30s where it had been lodged for a year and a one-half. It kept on through the $60s in early on Feb of last yr. And, the industry gave a sigh of relief. Thanks to higher prices and price-cutting, cash menses had returned! Soon it was going to pelting money!

Other drivers

OXY also has several international drivers worth noting, the North Sea, The UAE, and Sultanate of oman. They also are one of the leading operators in the Gulf of Mexico. OXY is a leader in several facets of carbon capture and mitigation. All of these have been described in detail in past articles. Every bit this is my 17th article on the visitor, I am going to link all past articles that deal with these aspects of the visitor for your review, should you be then inclined. Some detail ones that may be helpful are shown beneath.

"OXY: My Oh My..."

"OXY: For Those Who Have The Stone..."

"OXY: A Hitchhiker's Guide To Tier I acreage.."

"OXY: Indulge Me In A Bit Of Whimsey...."

"OXY: Capitalizing On The Carbon Capture Craze.."

That ought to keep you decorated a while. I encourage you to read them for exposure to the vast storehouse of noesis they comprise, and the fact each click will contribute a few cents to keep me in the amber Scottish swill that eases the transition from the labors of the day to the contentments of the evening. Maybe a teensy bit before on rainy days.

Your takeaway

It'southward been a long slog for OXY and for me, to exist honest. There were moments of doubt. Absent the two events discussed above, we could exist having an entirely dissimilar chat, and picking through the ashes. There'southward an old proverb in the oilfield, "Information technology's amend to be lucky than practiced." I am sure I've used it before, but it doesn't injure to acknowledge it again. OXY dodged a bullet...just, dodge it they did.

When OXY reports Q-4, here is what I am expecting. OCF in the neighborhood of $iv.0 bn, which minus capex of ~$650 mm or so volition leave $3.50 bn of free cash. I call up debt will drop below $27 bn, the visitor has been crystal clear that deleveraging is a priority numero uno. Warren B. will get his $200 mm and the minuscule $0.01 dividend volition be funded, leaving a few hundred million to perhaps bump upward capex to selection upwardly a few more rigs.

OXY at present is trading at EV/OCF multiple of 5.2X. If cash flow does increase as I project to keep that multiple, the shares will rerate to $54 or so over the side by side couple of quarters. That's a squeamish crash-land from nowadays levels of almost 50% of the current share cost.

If that'due south not incentive enough for you to pick up a few shares, I think we are a quarter away from a pregnant dividend increase announcement. It will even so exist fairly small, perhaps $0.25 per share. But, hey that'due south 25X the current dividend. I think we may as well see share repurchases. Below $50 I call up it makes sense, beyond that I'd rather see it in dividends.

Looking downward the road to exit 2022, I call up nosotros could see a share toll in the $60s equally debt falls over the form of the yr. That brings the stock back into historic levels for OXY. If oil stays above $seventy per barrel into 2023 should provide continued upwards momentum for the stock.

It turns out Miss Vicki and I were right all along.

Source: https://seekingalpha.com/article/4484749-occidental-petroleum-oxy-earnings-gets-knocked-down-but-gets-up-again

0 Response to "I Get Down but I Get Up Again"

Postar um comentário